Community Resource

Coronavirus Response & Relief Supplemental Appropriations Act

The $900 billion in emergency assistance for individuals, families, non-profits, and businesses impacted by the COVID pandemic was officially signed into law on December 27, 2020. In this summary we break down the provisions for Americans and households, how small businesses benefit from the bill, and just how the $900 billion is being allocated.

Topics Covered:

- Direct Payments to Americans

- Rental Assistance

- Unemployment

- Universal Charitable Deductions

- Small Business Support

- Paycheck Protection Program

- Non-Profit Eligibility

- Economic Injury Disaster Loans (EIDL)

- Payroll Tax Deferral

- Employee Retention Tax Credit

- Other Provisions, such as entertainment and postal service.

Download

Coronavirus Response & Relief

Jenn Gregory has compiled a summary of the Relief Bill focused on how it will impact you, your community, and your local businesses.

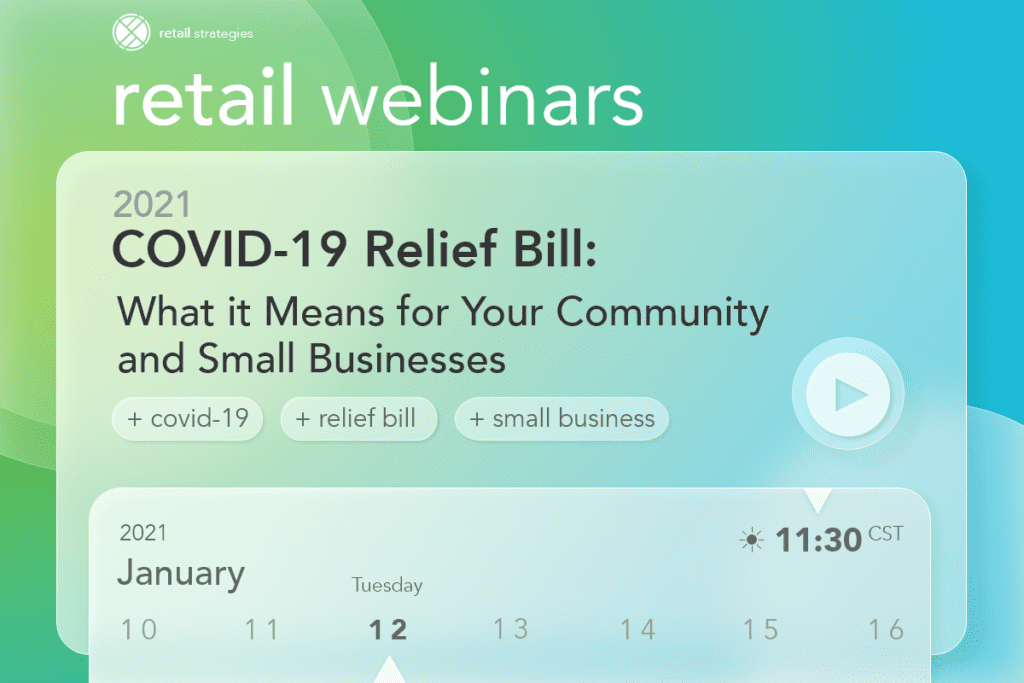

Join Us for a Webinar!

How will the COVID-19 Relief Bill will impact you, your community, and small businesses?

Find out when Jenn Gregory, President of Downtown Strategies, discusses the pertinent aspects of the Coronavirus relief bill, how it is allocated, and what you (and your community) can realistically expect to see from the bill.

Tuesday, January 12th